Advertorial

As seen in:

Thousands Are Checking Every Day to See if They Qualify for This Debt Relief Program

Feeling overwhelmed by mounting credit card bills? Do they keep piling up month after month, making it feel impossible to get ahead? Fortunately, there may be a solution—and it doesn't involve taking out another loan.

Protect yourself from scams and confidently take control of your financial future.

Rule #1: Don’t Get Scammed!

The solution is both simple and secure: Take the FinanceAdvisors.com Debt Quiz.

Why Choose FinanceAdvisors.com?

- Top-Rated Debt Relief Companies: FinanceAdvisors.com identifies and reviews the top debt relief companies in every state.

- Strict Criteria: Every partner must meet high standards, including positive reviews, strong ratings, and business qualifications.

- Personal Vetting: What sets FinanceAdvisors.com apart is their personal vetting process—they mystery shop each recommended partner to ensure the best customer service and processes in your area.

- Ongoing Research: Their research is continuously updated to keep pace with industry changes, ensuring you always receive the best recommendations.

Proven Success

With over $15 billion in settled debt, thousands of people are using the FinanceAdvisors.com Debt Quiz every day to check if they qualify for debt relief. In fact, more than 850,000 Americans have already enrolled, and many have settled their debt for less than they originally owed, cutting years off their repayment schedules.

Checking Your Eligibility Won't Affect Your Credit Score

Nearly anyone can check their eligibility for this program, and the best part is that it won't impact your credit score. There's really no reason not to find out if you qualify. Just imagine what you could do with the money saved—pay off your mortgage faster, build wealth, or finally take that vacation you've been dreaming of.

How to Check Your Eligibility:

Step 1:

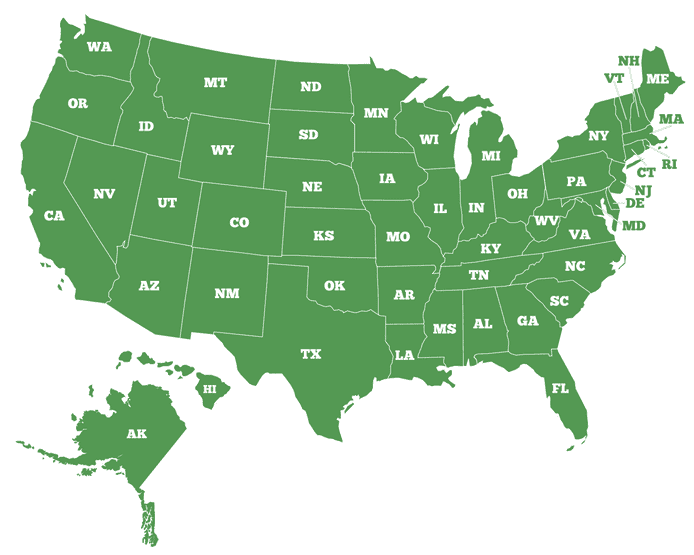

Click on your state in the map below.

Step 2: Answer a few quick questions, and find out if you qualify for the program.

THIS IS AN ADVERTORIAL AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE

*Estimates are based on prior results, which will vary depending on your specific enrolled creditors and your individual program terms. Not all clients are able to complete their program for various reasons, including their ability to save sufficient funds. We do not guarantee that your debts will be resolved for a specific amount or percentage or within a specific period of time. We do not assume your debts, make monthly payments to creditors or provide tax, bankruptcy, accounting or legal advice or credit repair services. Our service is not available in all states, including New Jersey, and our fees may vary from state to state. Please contact a tax professional to discuss potential tax consequences of less than full balance debt resolution. Read and understand all program materials prior to enrollment. The use of debt settlement services will likely adversely affect your creditworthiness, may result in you being subject to collections or being sued by creditors or collectors and may increase the outstanding balances of your enrolled accounts due to the accrual of fees and interest. However, negotiated settlements we obtain on your behalf resolve the entire account, including all accrued fees and interest. C.P.D. Reg. No. T.S.12-03825.

Copyright 2024 smartsavingsjournal.com